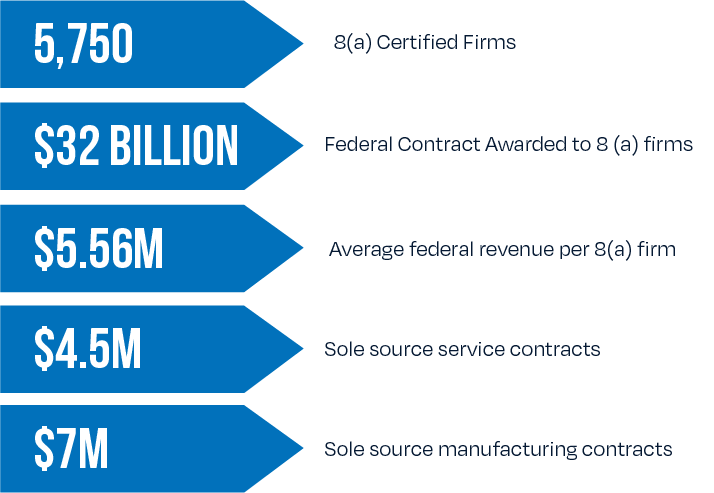

The SBA 8(a) Business Development Program is designed to help socially and economically disadvantaged businesses secure federal contracts and receive personalized business development support. This certification offers access to exclusive set-aside and sole-source contracts, helping small businesses grow in the competitive federal marketplace.

To qualify for SBA 8(a) certification, a business must:

Benefits of SBA 8(a) Certification

8(a) Business Development Program

• Developmental Stage (1–4 Years)

• Build capacity with training and contracts.

• Transitional Stage (5–9 Years)

• Prepare for independence and compete outside 8(a).

2023

Applicants may encounter difficulties with documentation, financial eligibility, or the certification process. BizPlanEasy simplifies this by offering comprehensive support to ensure your application is complete and compliant with SBA standards.

FAQs SBA 8A Certification

Stay Ahead with Easy Business Planning Tips

Join our newsletter to receive expert advice, actionable insights, and the latest trends in business planning. Subscribe now and take the next step toward growing your successful business!